An insurance estimate review is a vital process for vehicle owners post-accident, ensuring fairness in compensation for repairs like body work or paint jobs. It involves scrutinizing the insurer's quote, checking against industry standards and alternative estimates, to identify potential errors, hidden costs, or inflated prices. This proactive step protects financial interests, promotes transparency, and aids in achieving an accurate claim settlement.

In today’s complex insurance landscape, understanding your policy’s fine print is crucial for financial well-being. An insurance estimate review goes beyond the initial quote, unveiling hidden costs and benefits that could significantly impact your wallet. This article delves into the significance of this process, highlighting how a comprehensive review can enhance financial security. We’ll equip you with effective strategies to navigate and optimize your insurance choices, ensuring you make informed decisions.

- Understanding Insurance Estimate Review: Unveiling Hidden Costs and Benefits

- The Impact of Comprehensive Insurance Estimate Review on Financial Security

- Effective Strategies for Conducting a Thorough Insurance Estimate Review

Understanding Insurance Estimate Review: Unveiling Hidden Costs and Benefits

An insurance estimate review is an essential process that goes beyond simply accepting or rejecting a quote. It involves scrutinizing every detail within the estimate to uncover potential hidden costs and benefits, ensuring you’re making an informed decision. Many policies, especially for auto body services or vehicle bodywork repairs following an accident or collision, can include complex terms and conditions that are easy to overlook.

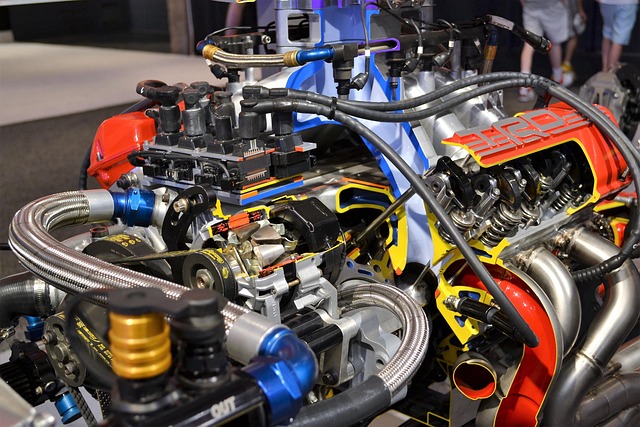

By thoroughly reviewing your insurance estimate, you gain a deeper understanding of what’s covered and what isn’t. This includes assessing the proposed repair methods, materials used in auto collision repair, and whether they align with industry standards and your expectations. Furthermore, it allows you to identify any discrepancies or potential overcharges, giving you the power to negotiate and secure more favorable terms for your specific needs.

The Impact of Comprehensive Insurance Estimate Review on Financial Security

A thorough insurance estimate review is a vital step in safeguarding your financial security and ensuring you receive fair compensation after an accident. When you’re dealing with the aftermath of a vehicle collision repair, car paint services, or dent removal, every dollar counts. An unbiased review of the estimated costs can help prevent overcharging and ensure that you’re not paying for unnecessary services.

This process involves critically examining the details of your insurance provider’s estimate, cross-referencing it with industry standards, and comparing it to estimates from reputable repair shops. By doing so, you can identify discrepancies, understand what’s included and excluded, and challenge any inflated or inaccurate figures. This proactive approach not only protects your wallet but also promotes transparency and accountability in the insurance claims process.

Effective Strategies for Conducting a Thorough Insurance Estimate Review

Conducting a thorough insurance estimate review is paramount to ensuring fair compensation for your claims. Begin by meticulously examining every detail in the estimate, cross-referencing it with the damage to your vehicle. Compare the costs of parts and labor against industry standards using reputable online resources or consulting with trusted automotive professionals. This verification process helps identify potential discrepancies or inflated charges.

Moreover, delve into the scope of repairs outlined. Ensure that all necessary auto body services, such as car body repair or vehicle repair services, are accurately reflected in the estimate. Check for recommendations from qualified mechanics or certified repair facilities to validate the proposed work’s quality and necessity. An astute review can save you money and ensure your insurance claim is settled accurately, promoting peace of mind during an already stressful situation.

Insurance estimate review is not just a checklist; it’s your key to financial security and peace of mind. By delving into this process, you uncover potential hidden costs and benefits, ensuring your coverage aligns with your needs. Armed with this knowledge, you can make informed decisions, avoid unnecessary expenses, and navigate the complexities of insurance with confidence. Remember that a thorough review is a game-changer in protecting your financial future.