Understanding and thoroughly reviewing your insurance estimate is key to navigating claims, making informed decisions during vehicle restoration, ensuring fair pricing, and maximizing savings. Examine cost breakdowns for parts and labor, verify all offered services, clarify ambiguous terms, compare quotes from multiple insurers, adjust deductibles wisely, explore bundling options, and claim applicable discounts like those for safe driving or membership affiliations. A meticulous insurance estimate review can uncover significant cost savings while ensuring adequate coverage for unforeseen events such as collision repair or tire services.

“Unraveling the complexities of your insurance estimate is crucial for making informed decisions about your coverage. This comprehensive guide, ‘Insurance Estimate Review: Key Insights for Consumers’, equips you with essential tools to navigate this process effectively. We demystify industry jargon and terms, breaking down each aspect of your quote. By understanding key elements and negotiating strategies, you can maximize savings while ensuring adequate protection. Dive into these insights to become an empowered consumer in the world of insurance.”

- Understanding Your Insurance Estimate: Decoding the Language and Terms

- Key Elements to Analyze in a Comprehensive Insurance Estimate Review

- Maximizing Savings and Protection: Strategies for Negotiating Your Quote

Understanding Your Insurance Estimate: Decoding the Language and Terms

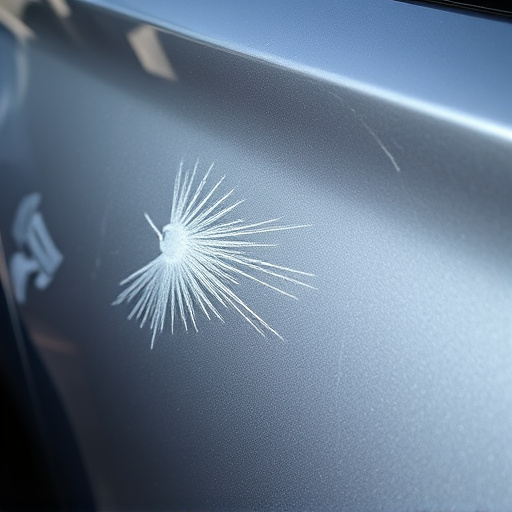

Understanding your insurance estimate is a crucial step in navigating the claims process and ensuring you get the best value for your money during a vehicle restoration or car collision repair. Insurance estimates often contain complex language and terms that can be confusing, especially if you’re not familiar with the industry. Decoding these can help you make informed decisions about your repairs, whether it’s opting for paintless dent repair to minimize damage or understanding what’s covered under your policy.

Pay close attention to detail when reviewing an insurance estimate. Key elements include breakdown of costs for parts and labor, estimated time for repairs, and any additional services offered. Also, clarify terms like deductibles, which is the amount you pay out-of-pocket before insurance covers the rest; coverage limits; and exclusions, which are circumstances not covered by your policy. By familiarizing yourself with these aspects, you can better compare quotes from different providers, choose suitable repair options such as paintless dent repair for less invasive damages, and ensure a smoother car collision repair process.

Key Elements to Analyze in a Comprehensive Insurance Estimate Review

When reviewing an insurance estimate, consumers should scrutinize several key elements to ensure they understand and are comfortable with the proposed repairs. Firstly, examine the detailed breakdown of costs for each component of the car bodywork that requires attention. This includes labor rates and part prices, which can vary significantly between collision repair services. Compare these figures against industry standards to verify fairness.

Additionally, verify that the estimate includes all necessary services required to return your vehicle to pre-incident condition. This may encompass not just collision center repairs but also paint matching, color correction, and ensuring proper alignment. Check for any hidden fees or additional charges that could arise from specific procedures or parts replacements. An astute consumer will always request clarifications on any ambiguous items within the insurance estimate review process.

Maximizing Savings and Protection: Strategies for Negotiating Your Quote

When reviewing an insurance estimate, one of the primary goals for consumers should be maximizing both savings and protection. There are several strategies to negotiate your quote effectively. Firstly, compare multiple offers from different insurers. Each company has its own assessment criteria, so you might find substantial variations in premiums. Secondly, review your policy deductibles; increasing them can significantly reduce costs but ensure it aligns with your financial comfort level and risk tolerance.

Additionally, consider the scope of coverage. For instance, if you own a vehicle, explore options for bundling auto insurance with home or life insurance policies, as insurers often offer discounts for multi-policy holders. Furthermore, for those who drive sparingly or have safety features installed in their vehicles, such as anti-lock brakes or air bags, might qualify for discounted rates from certain carriers. Lastly, don’t hesitate to inquire about discounts related to your occupation, student status, or membership in specific organizations—insurers often have promotional offers that could lower your premium. Remember, a thorough insurance estimate review can unlock substantial savings while ensuring adequate protection for unexpected events, including auto collision repair needs or tire services.

An insurance estimate review is not just a formality, but a crucial step towards securing optimal coverage at the best price. By understanding the key elements discussed in this article—from decoding policy lingo to negotiating your quote—consumers can make informed decisions and navigate the complexities of insurance estimates with confidence. Remember, a thorough review can lead to significant savings and enhanced protection, ensuring you get the most value for your investment.